A neighbor posted the following in response to a Facebook post I put about the need to eliminate Exclusionary Zoning in the Atlanta Region in general, and in our city of East Point in particular:

"Can you explain to me how East Point is growing at a rapid rate? I’ve seen some residential properties being worked on, and there has been some progress there.

Additionally, what community does this inclusive housing actually serve? Who has the money to build a livable accessory structure from scratch in their backyard so they can rent it out? Or who has the money to buy a property where there is already an additional space to rent?"

My Response: Sure, It's pretty straightforward.

It's pretty much the same answer you would give to the question "Who has the money to pay cash for a house?" You need some cash, but you finance an ADU or finishing a basement the same way as you do the house; some cash, leveraged with some plain vanilla mortgage debt.

The same mortgages sources, FHA, VA, Fannie Mae, and Freddie Mac have all set up their basic residential home loan for 1 to 4 units. If you live in one unit and rent out a second unit, their mortgage lenders will count 75% of the gross rent from that unit toward your income when they evaluate your Debt to Income Ratio (DTI) as part of the underwriting process for your loan. The Debt to Income Ratio compares your monthly debt payments to your monthly income. Typically the loan programs listed above don’t want that number to be above .45 to approve your loan. That means that for every $1.00 of monthly income you earn, you only have $.45 in monthly debt payments.

The most common approach to finance adding an Accessory Dwelling Unit is to get a construction loan from a local bank or credit union, use a Home Equity Line of Credit (HELOC), or a Purchase/Renovation loan like the Fannie Mae HomeStyle or the Freddie Mac CHOICE Renovation Loan.

When housing in the neighborhood gets more expensive, the appraised value of your house goes up. Now you can use that additional appraised value as your equity to finance the construction of adding a unit in a wing on the back of your house, finishing the basement or building a free standing ADU.

The new loan on the house with the new ADU is going to be based upon the Completed Value of the property. The lender will typically lend you 80% of the completed value to do the project (If you live in one of the units FHA, Fannie Mae, and Freddie Mac loan programs will allow you to borrow 95% of the completed value if the rest of your application pencils, (your DTI, credit score, and Debt Service Coverage Ratio). If you don't put down 20% in equity you will have to pay Private Mortgage Insurance, just like when you get any other residential mortgage.

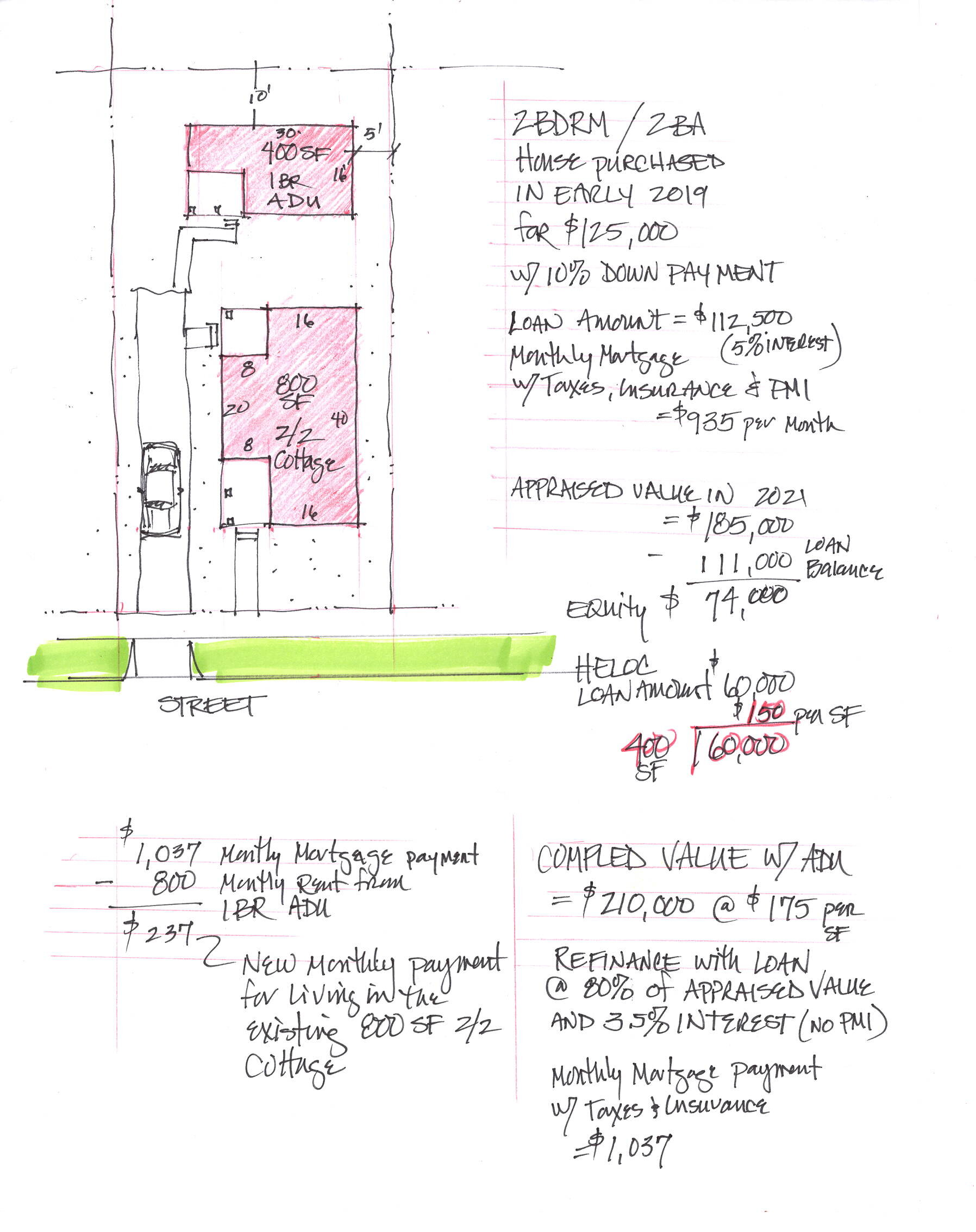

The sketch above shows a 400 SF one bedroom ADU cottage built behind an existing 800 SF two bedroom existing house on a 50’ x 100’ lot, which is typical to the older neighborhoods of East Point. The assumptions in this example are:

The 800 SF house was bought with 10% down payment and a loan with 5% interest and PMI in early 2019 for $125,000. Not uncommon in Center Park in early 2019.

It appraises now for $185,000 at $175 per SF.

Subtract the current unpaid loan balance of $111,000 and you have $74,000 in equity in the existing house.

Based upon a reasonable credit score of 700, your income, and debt to income ratio, your bank is willing to give you a Home Equity Line of Credit (HELOC) of about 80% of that equity, or $60,000. If you don't have any more cash to put into the construction of the ADU, then you need to divide $60,000 in available HELOC funds by 400 SF, that limits your construction budget to $150 per SF. Quite doable on the fringe of Atlanta --even with today's crazy lumber prices if you design the ADU competently and you are willing to insulate, hang & finish the drywall, paint the interior & exterior, and tile the bathroom yourself.

If you rent the one bedroom ADU for $800 a month plus utilities, you can refinance the property, paying off the original mortgage balance and the HELOC and have 20% equity so that you are no longer paying PMI.

Your new mortgage at today's lower rates (say 3.5% and no PMI) is $1,037 up from your previous monthly payment of $935, so if you don't have the ADU rented you just need to come up with an additional $100 a month, so a month or two of vacancy is not a serious risk to your household budget.

Now subtract the $800 a month rent from the new $1,037 mortgage payment. Your share of the monthly mortgage for living in the existing house in front is $237 a month plus utilities.

By reducing your monthly housing cost, the largest single number in your domestic overhead, your household will have a lot more flexibility and resiliency in these weird times. If you get laid off or get your hours cut you are not in danger of losing your house to foreclosure.

Who does actually serve? Being able to add a unit or two to an existing property could serve the folks who live in East Point now, both someone who owns their house and someone who is a tenant, who would like to move out of a large apartment complex and maybe not have to share wall and a ceiling with loud neighbors. Maybe they would like to be able to afford a nice place to live close to services and to MARTA without having to share a bathroom with a roommate.

Think about how Exclusionary Zoning impacts those same people. The tenant whose rent continues to increase because nobody is building any new rental housing in East Point. The young family or single person who would like to buy their first house in East Point to be near family, who keeps getting out bid on the homes they look at because there is so little for sale housing inventory in the Atlanta metro area (now 4 weeks vs. the needed 4 months supply for a balanced market). The elderly neighbor who needs an accessible place to live and wants to stay in the neighborhood. Maybe they own their house free and clear, but property taxes already take a bite out of their fixed income and they are not able to keep up the maintenance on their house. Move into the little accessible cottage in the back and rent out the original house after it gets renovated, maybe end up with some additional monthly income above and beyond the mortgage, since the house was paid off before they built the ADU and took care of the deferred maintenance.

The metro region is growing in population and we have not been able to keep up with housing supply. That math is relentless and it impact people every day. The math for building in ways that can fit into our existing neighborhoods can work in our favor.

I like my neighbors and I would really like to have a few more of them on my street. I’d also like to make sure the folks who live here now are not going to be displaced and leave the neighborhood as housing costs increase.