Because Money. Specifically to understand how 30 year mortgages can work for a four-plex or four unit mixed use building.

Finding a mortgage for a small apartment building or a small mixed use building can be challenging. You take out a construction loan to build/rebuild the building and then you look for a longer term mortgage that is typically based upon the property’s income after expenses. You could get a Commercial Mortgage from a local bank which requires a commercial appraisal and typically have a 5 or 7 year term. These loans come with a specified amortization rate (often 25 years) and a balloon payment due at the end of the 5 or 7 year loan term.

There are some off-the shelf alternatives available from the FHA, VA, Fannie Mae and Freddie Mac for buildings with 1-4 dwelling units. Each Loan program has a different upper limit on how much Non-Residential Space is allowed within the building.

Loans that have very low down payments 0% for the VA, 3.5% for the FHA, and 3.5-5% for some Fannie Mae and Freddie Mac loans require that the one of the 4 units be occupied by the building owner for a minimum of one year. Loans with less than 20% borrower equity/downpayment require some form of Private Mortgage Insurance (PMI) With the FHA loans you will pay PMI for at least 11 years regardless of how much down payment you provide.

Loans from Fannie Mae and Freddie Mac with a minimum downpayment of 20% are considered Conforming Loans, some of these loan products allow for a Cash Out at closing as long as the 20% equity is provided.

How Much Non-Residential Space?

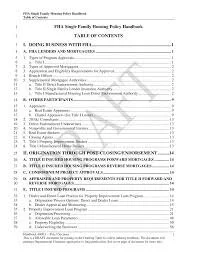

This percentage varies with the loan program. The top of the list is the FHA 203(b) standard 1-4 unit mortgage which allows for up to 49% of the building area to be Non-Residential Space as long as the uses and building configuration conforms with local zoning. This percentage was increased in the FHA’s bread and butter loan product from a 20% limit to 49% in September of 2015. If you didn’t read the 2015 edition of the HUD 4000.1 Single Family Housing Policy Manual you probably missed the new section added under the heading Mixed Use. https://www.hud.gov/program_offices/housing/sfh/handbook_4000-1 The manual contains all of the underwriting criteria for HUD and FHA loan products.

The HUD 4000.1 manual also contains the criteria for the FHA 203(k) Purchase/Rehab Loan. The 203(k) has the same underwriting and allows for 49% non-residential space. A two story main street building with four apartments on the second floor will have a stair or two taking up space on the ground floor. If the ground floor footprint is the same size as the second floor there’s your 49%. If the ground floor is slightly larger than the second floor, consider carving out some ground floor space for a bicycle garage or for storage cages for the residential tenants. Figure out how to hack your building to comply with the off-the shelf financing. If you have a 5 units above commercial, combine two units so that you have 4. The Fannie Mae guide lays out the particulars of Fannie Mae’s HomeStyle Purchase/Rehab loan. also a 1-4 unit product that allows 25% non-residential space.

These federally insured loan programs all publish and periodically update their underwriting guides, which they provide to banks and credit unions so that those folks can follow the rules required to sell you one of these loans. All of these guides refer to 1-4 unit buildings as “Single Family”, even if there are more than one dwelling unit and a some non-residential space in them. That comes from the original legislation that set up the federal guarantees. These underwriting manuals are distributed over the Internet, so you can read them too.

https://selling-guide.fanniemae.com/

https://guide.freddiemac.com/app/guide/

https://www.benefits.va.gov/warms/pam26_7.asp

Access to the underwriting guide is equivalent to finding a teacher’s edition to your 8th grad history textbook in the parking lot, with all the answers to the quizzes in the back. When you apply for one of these loans, the loan office (someone paid a base salary plus bonus, so pretty much a commissioned sales person) sends your application to the Underwriting Department of their bank where the salaried staff reviews the application with the criteria laid out in the lending guide. Underwriting is responsible for two things.

1.) Make sure that the commissioned sales people don’t put the bank at risk while pushing sales.

2.) Make sure the loan conforms to the underwriting guidance so that it will be insured and sold in a bundle of mortgages on Wall Street or purchased by Freddie Mac or Fannie Mae.

It is typical for the small developers we have coached to know more about the finer details of these loan products than the loan offices they are talking with. You will probably have to show them the citations from the underwriting guides.

Again, why would you go through the trouble of reading a technical manual like this? Isn’t that the banker’s job? Well, sort of. Just don’t expect that loan offices or loan brokers have read this stuff. They tend to sell the loan products they are familiar with and leave the details to the staff in the Underwriting Department.

So why read these manuals? Because Money. For small projects Form Follows Finance. Just like local zoning codes and building codes, you are going to want to understand the rules for off-the-shelf government insured 30 year mortgages. They are an excellent alternative to a 5 year Commercial Mortgage.